Recently, the health agencies for many of the world’s largest countries declared COVID-19 a global pandemic. Soon thereafter, many of those same countries began enacting laws and regulations which, effectively, shut down large portions of the global economy.

Those actions, while expected to save lives, have nonetheless drawn criticism from some quarters for their overall impact on the economy and the long-term implications the resulting slowdown may have on the health and well-being of large portions of the global population. To be fair, such concerns may be warranted, given that over 1.7M people die each year due to poverty and associated issues such as malnutrition, starvation, access to clean water and sanitation. That’s more than HIV/AIDS, tuberculosis, malaria, breast cancer, and prostate cancer combined.

In short, what started out as a global health crisis, has evolved into what may well be the greatest fiscal crisis of our time – one which will impact future generations for years to come.

My fund focuses on founders, startup entrepreneurs, and early stage investors – all of whom are struggling to understand the impact the crisis will have on their operations and investments. With that in mind, you might expect to find us in a panic, frantically running around trying to save our portfolio, in between bouts of hysteria.

Though that might make for good reading, I’m sorry to report that such is simply not the case. Startups just don’t work that way. In fact, I believe that in the long run, this sort of crisis may actually benefit many pre-seed and seed stage startups. Now you might think I’m crazy, naïve, or overly optimistic – but I can assure you that I have my reasons.

In fact, over the course of my career, I’ve launched over a dozen startups across multiple industry verticals. Over that time, I’ve raised over $200M in capital; closed pre-seed, seed, A, and B rounds; led fifteen major M&A transactions; took three companies public; answered to dozens of professional analysts; and reported to over 40,000 shareholders. In addition, I lived through and successfully navigated various startups through pullbacks and recessions in 1990, 2001, and 2008. So, as an entrepreneur, I’ve seen more than most.

With that out of the way, let me offer some insight on early stage startups in times of economic crisis.

Startups vs. Later Stage

To begin – let’s consider the impact on the startup ecosystem vs. later stage business models. Startups are generally trying to find ways to capture market share against much larger, better funded competition that has already raised A, B, or C-Round capital.

In a normal market, the only way to build market share is to develop better tools, functions, features, services, or pricing to entice customers away from existing solutions. That’s no small task, as it’s much more difficult (and expensive) to capture new customers than it is to keep them once you land them. In fact, this is one of many reasons why building user loyalty is so important for startups and early stage companies.

However, in the event of a crisis, the rules change. Later stage teams have an entirely different set of problems to navigate when compared to their seed stage peers. Conventional wisdom may suggest that teams that have already raised A and B-Round funding, will be better positioned to weather the storm, but that is simply not the case.

It takes a lot of money to feed the beast

Most later stage teams have already used venture funds to expand operations, hire staff, move into new offices, acquire customers (marketing), and purchase software and resources – all in an effort to continue scaling. You see, it’s easy to grow at 10% month-over-month when you’re just getting started, but things get much harder as you begin to hit higher revenue milestones (generally around $100K / month).

In other words, A and B stage teams have much higher burn rates and are far more dependent on customer spending and cash flows. Pre-seed and seed stage startups, on the other hand, are used to running lean, and few are dependent upon revenue.

Generalists vs. Specialization

In addition, later stage teams will be forced to cut costs very early in any financial crisis, in an effort to extend their runway. This means laying off large portions of staff which, in turn, means losing large amounts of institutional knowledge and expertise. Gone are the days when a small team handled every customer. Now you’ve got key points of customer contact and support, along with invaluable customer insight, walking out the door.

Compounding this problem, later stage teams often can’t remember what it means to be a startup. Things have become compartmentalized, with a heavy reliance on specialized skills. In contrast, most startups have a core team that works as one, with each member being able to pick up the slack as needed.

Further, startups are purpose built to survive. Teams buy into the vision and mission of the venture. It’s not a job – it’s a passion. That makes for good rhetoric in a later stage company, but it doesn’t really work that way in the real world. Try cutting off payroll in a venture that has raised A or B-round funding and see how that works out for you. Early stage startups are much better suited to survive because the team believes in the long-term goal and they’ll do almost anything to get there. Honestly, in my experience, it’s far more common for early stage founders to hang on too long, rather than give up too early.

Legacy vs. Adaptability

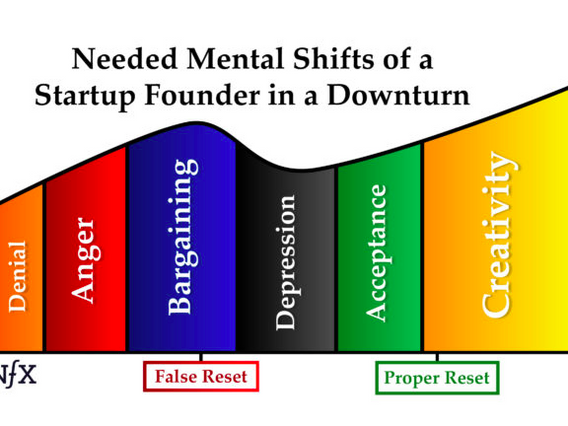

For all the reasons listed above, later stage teams are much more likely to lose focus during a downturn, and it takes considerably longer for them to get back on track once things start returning to normal. Startups, in contrast, lose very little momentum – they aren’t burning through tons of cash; nobody was expecting much from them in terms of revenue; and they’ll likely use the slowdown to refine their value proposition to best position themselves for where the market will be when the brakes come off.

As a result, startups are typically moving much faster when the recovery begins. Later stage teams are busy rehiring lost knowledge and skillsets in an effort to rebuild the same engine they had prior to the slowdown. This takes time and may not even align with the current state of the market. Startups, on the other hand, were moving at full speed and have likely already adjusted all aspects of their business to align with the “new normal.”

To illustrate, imagine a NASCAR race following a crash. All of the cars have to slow down to 55 MPH and drop in line behind the pace car. Those cars represent the mature teams that have raised A and B-Round funding. When the green flag goes up and the pace car drops off, it will take them time to run through their gears and get back to top speed. In addition, their tires have cooled down and their engines have heated up during the slower caution laps, so they have to adjust their strategy to compensate.

Now imagine another car under that same caution, but still moving at race speed (around 200 MPH). When the green flag goes up, they just keep the hammer down – no need to cycle through gears, no need to warm up the tires. In that scenario, the pack cars would look like they were barely moving. In fact, with the right line, that one car could blow by the entire pack before any of those cars could get up to speed.

That’s pretty much startups – no legacy infrastructure, no absolutes or sacred mantras, very little internal segmentation, and tons of flexibility. Startups focus on where the market will be when the crisis ends, and they build toward that goal. Later stage teams get hung up on what they had that was working prior to the crash – and that’s not always a good recipe for success.

OK – That’s all fine and good, but what are things going to look like when things begin to return to normal?

There are a lot of theories about how people will react, and how the economy will perform, once things start going back to normal. Forgetting for a moment that last bit (what’s “normal” going to look like), most of the articles I’ve seen have compared the current crisis to the economic recessions of 2008 and/or 2001. Personally, I don’t think those are good comps for this situation.

In fact, I think this will look a lot more like the aftermath of WWII (as opposed to 1991, 2001 or 2008). Consumers will spend, as they will be anxious to get out – particularly after being stuck in their homes for weeks on end. Obviously, unemployment will be up, perhaps to levels most of us have never seen in our lifetime. However, by and large, those with discretionary spending coming into this crisis will remain, for the most part, intact.

Bear in mind that in the decade leading up to WWII, annual unemployment rates hovered between 14% and 21%. In fact, single digit unemployment is a relatively recent phenomenon, with a long single digit run following World War II through 2019 (with 1982 being the sole outlier).

And, much like what happened following WWII, I suspect we’re going to see a resurgence in manufacturing and infrastructure investment here in the U.S. – probably unlike anything in the last 30+ years. So much for all the political rhetoric over “which jobs matter.” This should be a wakeup call for the masses. Beyond the critical work of doctors, nurses, and scientists on the front lines, whatever happens next will depend, in great part, on the efforts of countless truckers, farmers, clerks, stockers, factory workers, and other “blue collar” heroes.

As we move forward, I would expect to see increased public and private spending in many areas that have long been overlooked. In addition to manufacturing and infrastructure (which will now become national security mandates), think logistics, transportation, and agriculture, for example.

So, bringing this all home. How has our fund approached this crisis, and what do we expect moving forward?

Well, as you might have already guessed, my partners and I are spending a lot of time working with the teams in our portfolio. Here are some of the items that I’m personally focused on:

- Founders need to understand that everything is graded on a curve. Don’t get down on yourself because your business has stopped growing at 20% month-over-month. Everybody is down. The key is to outperform your peer group and to be ready when the green flag goes up.

- Revenue numbers will be down for many early stage startups (likely for the first two quarters), but I believe lasting implications are unlikely.

- Teams should use this time to refine their business / product / services. It’s not often as a startup that you have downtime like this. Unless you’re in stealth mode, you’re typically under a constant barrage from customers, partners, and investors to add new features, launch new products, or make other changes to your business. Right now you have a rare opportunity to get very strategic.

As a fund, we benefit greatly from the diversity of our portfolio. While some sectors are obviously down, including travel, hospitality, ridesharing, and food services – other sectors, such as MedTech, health and wellness, remote working, business productivity, esports, food tech, AgTech, apps and social media, are up.

Now that’s not to say there won’t be any impact.

To begin, exits through both acquisition and IPO will be way down this year – and that will be across all levels of venture. That’s unfortunate, as this had the potential to be a really strong year in that regard.

We’re also seeing A, B, and C-Round companies lowering valuations in order to raise bridge rounds and emergency capital. What we’ve seen so far would not qualify as down rounds per se, as they are typically dropping to the valuation at their last closing, but these adjustments could put pressure on other teams to follow suit. This sort of action also tends to roll downhill, forcing earlier teams to drop valuations as well. We haven’t seen much of this as yet, but it’s something to keep an eye on.

We’ll probably also end up writing down more teams in 2020 than we would have in the absence of this crisis, but we don’t expect those numbers to be too far out of line with last year. In most cases, I would expect the crisis to expedite failure, rather than cause it.

Given how this crisis has unfolded, and the likely fallout to follow, it is my expectation that teams in the U.S. will fare better than most. In particular, it is my belief that Europe, parts of Asia, and many emerging markets (that were growing rapidly in 2019), will see greater disruption for the foreseeable future.

Good Deals Still Thrive

As noted above, I’ve been through three other major downturns (leading startups). This is different, in the sense that it impacts both good and bad teams across almost all verticals – but it is also the same, in that all teams, at all times, and through all cycles, are graded on a curve.

So, as with past recessions and economic slowdowns, “good deals still get done.” In fact, teams from our portfolio have raised over $9.5M in seed stage funding since the beginning of March. Capital is still out there, and it is still moving – but it is much more focused on value, performance (metrics prior to the slowdown), and risk mitigation.